So what exactly is the Mortgage Reduction Strategy

Check out this quick video to find out!

Would you rather

Pay Your Lender

or Pay Yourself?

Your mortgage could be paid in full in what is often half the time of a typical 15 or 30 year mortgage. Our clients continually enjoy the maximum tax benefits (Please consult your tax and legal advisor as we do not offer any tax or legal advice) and minimal long-term life insurance costs all while having adequate insurance coverage to ensure your family will receive a deed free and clear in the event of one of a breadwinner’s death, provided that the in-force life insurance amounts exceeds the balance on the mortgage.

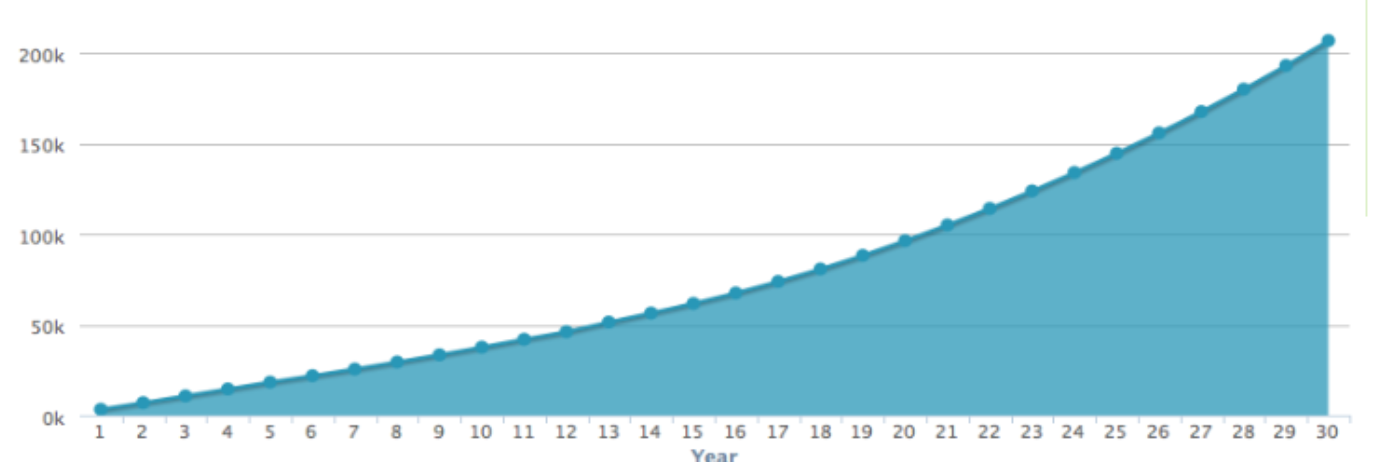

A Typical 30-Year Mortgage Schedule!

First let’s take look a typical 30-year $150,000 mortgage with a 6% interest rate.

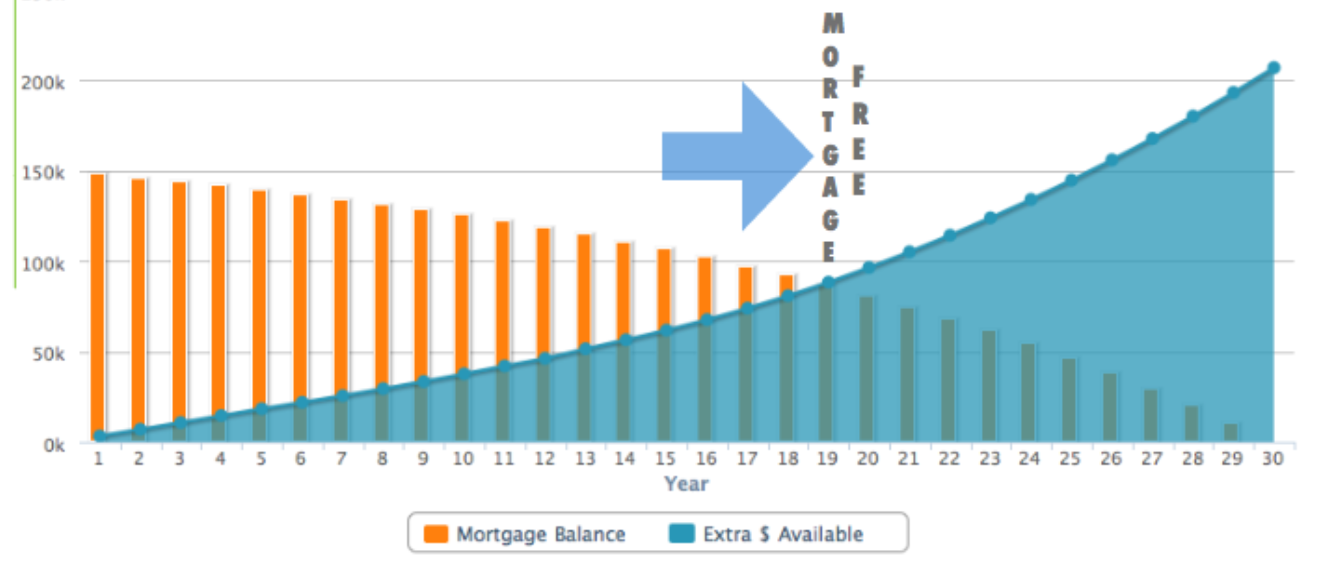

Your Mortgage Reduction Schedule!

Utilizing this strategy, you can see that on the 19 year you can successfully use cash-balance to pay off your mortgage IN FULL!

Now let’s combine the two!

Now let’s see what the cash balance for a typical Mortgage Reduction schedule looks like for a hypothetical client.